Charter Hall

Enquiries

Markets had much to digest over recent quarters: Liberation Day (tariff reset) in the US, escalated geopolitical tension, an Australian Federal Election, volatility in interest rates, and a welcome second Reserve Bank of Australia (RBA) rate reduction in May 2025. Unsurprisingly, global markets have been buffeted by significant volatility, and given the unprecedented nature of the ongoing tariff diplomacy, this could be more persistent.

Australia’s growth, however, is expected to accelerate over the year as the restrictive monetary environment unwinds. Concerns over a slowing economy and lower inflation results provide the RBA with capacity to lower interest rates further.

Following the largest commercial property devaluation cycle since the Global Financial Crisis (GFC), lower interest rates and higher economic growth will be more constructive for the performance of Australian commercial real estate. Importantly, the Australian commercial real estate sector now offers comparative certainty and compelling forward-looking risk-adjusted returns. The repricing of capitalisation rates combined with momentum in core commercial real estate occupier fundamentals are forming a strong platform for valuation growth over the near term.

Australia’s I&L sector is entering this period from a position of strength, having low vacancy, solid rental growth and longer-duration cashflows to high quality tenants at higher yields compared to historical averages. These attributes will be valuable in the midst of higher volatility and lower interest rates.

The I&L sector has been the beneficiary of structural tailwinds. Going forward, key thematics of digitalisation, demographics and defence continue to generate additional demand. At the same time, construction activity is expected to decrease from the levels recorded over the past year.

Demand across the sector has increased with the shifting patterns in consumer behaviour and growth in online shopping. A greater volume of goods are being shipped directly to the consumer from distribution centres. This has intensified demand for well-located assets as businesses are seeking to strengthen product availability, pricing and shorten delivery times. This trend is expected to continue as the Australian market continues to evolve and follow the path of more advanced global markets. Online shopping as a percentage of overall retailing in Australia reached 14% in May, comparatively below the global mature market levels of 20-30%.

The I&L sector is increasingly servicing the surge in data centre demand with the rapid growth in artificial intelligence and other digitalisation trends. The total capacity of the data centre market is forecast to increase by 2.4x by 20301, however, the market is facing significant shortages given the challenges in sourcing appropriate sites that have sufficient power and critical service infrastructure. As a result, there is an increased value for assets that meet the requirements for data centre operations and those that do are increasingly being repurposed for that use.

Across the sector, companies have renewed their focus on strengthening their supply chains and onshoring of essential goods. Inventory holding levels are expected to remain higher for insurance and there have been initial reports of re-routing of goods towards the Australian market to offset tariff-related trade issues.

These structural shifts are unfolding against the backdrop of growing demand from population growth and historically high levels of infrastructure development. The long-term requirements will grow even more because of short-term boosts from a growing economy. Improving household balance sheets, positive wage growth and increased consumption activity will continue to drive demand across the I&L sector.

1. JP Morgan Research.

2. CBRE Research, May 2025.

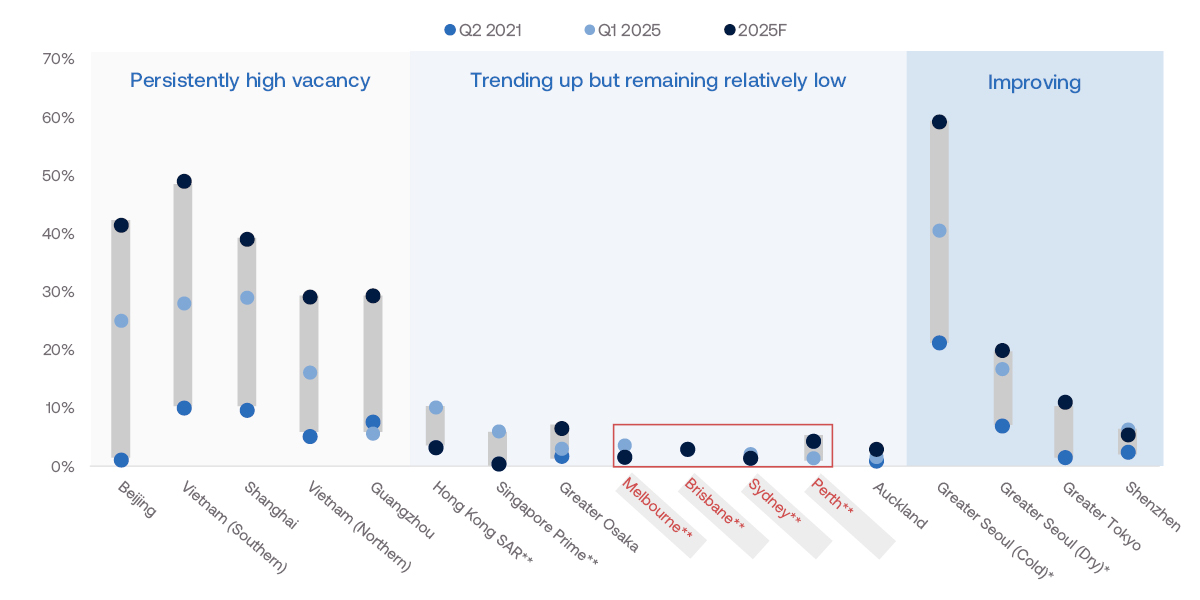

*Only Q4 2024 data available. **Vacancy forecasts are not available.

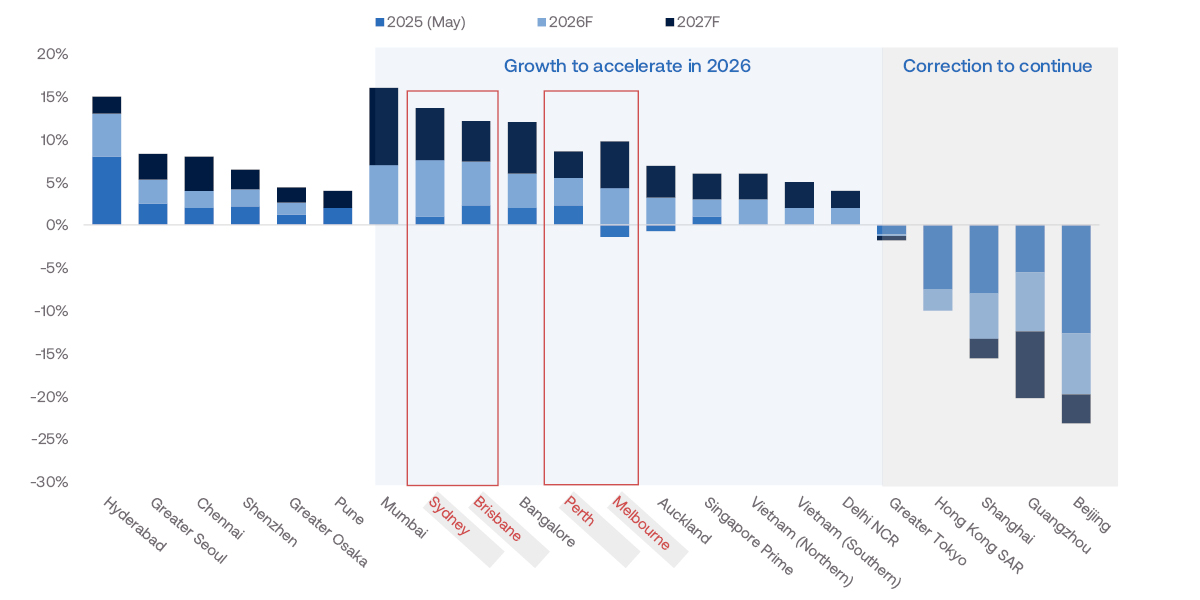

3. CBRE Research, May 2025.

4. Logistics rental growth for Asian markets refers to face rents while that for Pacific markets refers to effective rents. Rental growth for Singapore refers to prime logistics rents in the eastern and western areas only. Rental growth for Indian cities refers to specific precincts only.

Supply over CY24 reached historical highs, a delayed response to the significant tenant demand over recent years. The higher level of supply was accompanied by record levels of leasing activity. As such, the addition to national vacancy was limited – drifting up to 2.8% and remaining below the estimated market ‘equilibrium’ threshold of 4-5%.

Going forward, new supply is expected to fall. Constraints on the availability of zoned land and access to supporting infrastructure, alongside I&L higher economic rents and labour shortages have reduced expectations on short and medium-term supply. Construction and financing costs are easing, although developments continue to be challenged, particularly for those developers that bought land at peak values. Land values have grown significantly nationwide, averaging ~16% per annum over the last five years. New supply for this upcoming year is expected to fall 29% y/y, reaching levels below the five-year average.

The I&L sector enters this next cycle from a position of strength, having the highest rental growth and some of the lowest vacancy rates globally. Vacancy rates are expected to remain relatively low across all markets, as they remain well-balanced, given the combination of sustained demand and falling supply (see figure 1 on previous page).

A continuation of these market dynamics and low vacancy rates nationally will be a core driver for continued rental growth. Latest market forecasts anticipate rental growth to accelerate in CY26, outpacing other Asia Pacific markets, following a period of more constrained supply through CY25 (see figure 2). Notably, historic market rental forecasts have underestimated growth. Market forecasts at the start of CY24 anticipated rental growth of ~5.3%, whereas actual national rental growth was 9.5%.5

Capital market activity has reflected this positive outlook. I&L transaction volumes have returned to their highest levels since mid-2022 (see figure 3), with buyer interest increasing for both on and off-market sale campaigns.

6.jpg?sfvrsn=9e5271c2_0)

Key value indicators including increasing transaction volumes, capitalisation rate stabilisation, and interest rates starting to fall, are expected to result in capital value growth over the short and medium-term.

Importantly, the Australian I&L market has a track record of delivering leading risk-adjusted returns. Strong demand, comparatively low supply and an outperforming economy have contributed to stronger returns at lower volatility.

These leading demand and supply environment conditions, alongside the improving economic and consumption backdrop, and fundamental longer-term structural drivers, provide a strong foundation for solid value growth for the Australian I&L sector.

5. JLL, CBRE Research, Cushman & Wakefield.

6. JLL (1Q25), MSCI (Mar-25), Charter Hall Research.

Enquiries

This website has been prepared for information purposes only. Past performance is not a reliable indicator of future performance. This website is not intended to be and does not constitute a product disclosure statement (“PDS”) or disclosure document as those terms are defined in the Corporations Act 2001 (Cth). It does not constitute an offer for the issue, sale or purchase of any securities or any recommendation in relation to investing in any financial product. This website has been prepared without taking account of any particular investor's objectives financial situation or needs. While every care has been taken in the preparation of this website, Charter Hall Direct Property Management Limited (ACN 56 073 623 784, AFSL 226849 (CHDPML) does not make any representation or warranty as to the accuracy or completeness of any statement in it, including without limitation any forecasts or opinions, and persons viewing this website should conduct their own inquiries and investigations. Forecasts, opinions and estimates provided on this website are based on assumptions, contingencies and market conditions which are subject to change without notice, and may involve significant elements of subjective judgement and assumptions as to future events which may or may not be correct, and should not be relied upon as an indication of future performance. The information on this website is subject to change, and CHDPML is not responsible for providing updated information to any person. To the maximum extent permitted by law CHDPML disclaims all liability for any loss or damage which may arise out of the provision to or by any person of the information contained on this website. Before investing, you should consider your own objectives, financial situation and needs or you should obtain financial, legal and/or taxation advice.

© Charter Hall Group.